- 1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET HOW TO

- 1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET SOFTWARE

This includes all money received as part of your rental business activities including rent payments, application fees, tenant fees, pass through utility payments, and security deposits withheld. On the income side, all revenues are classified as ‘Rent Received’.

The Schedule E includes income and expenses categories common to owning rental properties.

1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET SOFTWARE

To stay organized and maximize their tax deductions, investors should use accounting software or a spreadsheet to help them maintain financial records year-round. Owners must total up these sources and any other revenues and expenses related to their properties. Your records, which should contain your receipts as well as information on any other deductible business expenses that you’ve paid for out of pocket. In January, banks will send a 1098-B statement summarizing the deductible interest paid on mortgages during the prior year. Property managers or property management software should track monthly operating income and expenses. The statements from your business bank account ( read why you need a business bank account) will contain a transaction history of money that you’ve received or expenses that you’ve incurred. Income and expense information to complete the Schedule E will come from several places. Your CPA or tax preparation software will then use your records to file a Schedule E as part of your return. Where to find your Income and ExpensesĪs an owner, you are responsible for tracking the income and expenses derived from your rental activities. Simply owning rental properties together with your spouse does not qualify for this election. This box, abbreviated as QJV, is used by spouses who each materially participate in and collectively own a real estate business. Even if the property is not considered a home, note that expenses related to Personal Use Days can not be deducted.įair Rental Days refers to the number of days that the unit was actually rented out- rather than the total time it was available to be rented. Generally, the property is considered a home if your personal use is in excess of 14 days, or 10% of the total days rented to others at fair price. The IRS uses these values to determine whether or not the property was used as a home, and subsequently whether or not your expenses are tax deductible. Fair Rental DaysĪfter entering your property’s address and type, you will enter the Fair Rental Days and Personal Use Days. If you are not exempt and do have to file 1099's the IRS deadline for these forms is January 31st.

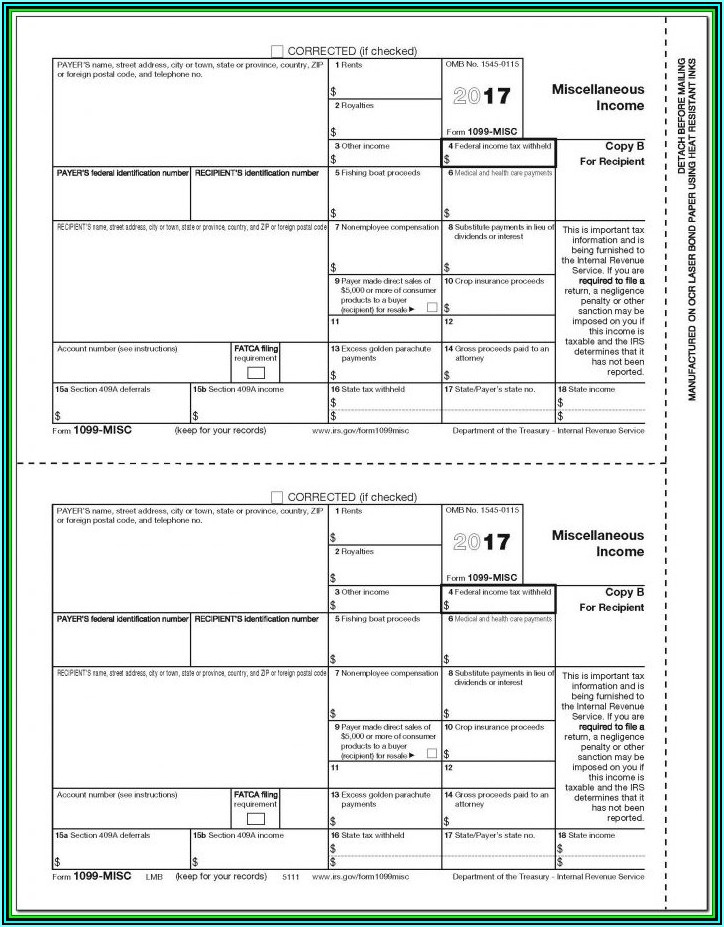

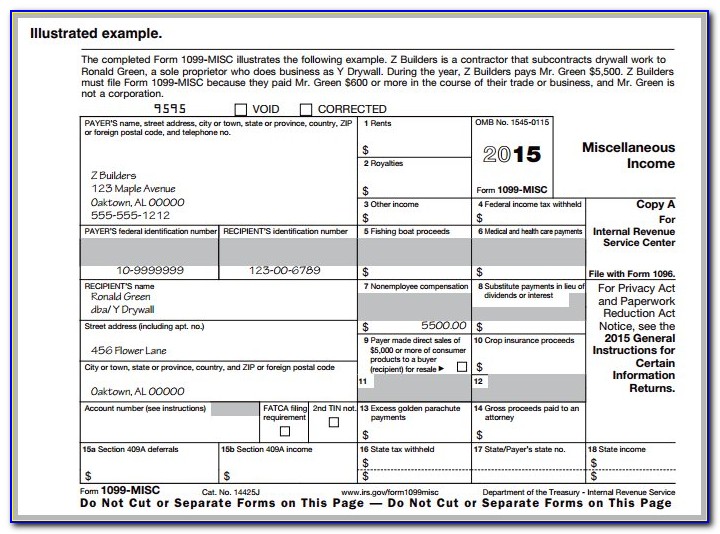

However, self-managing landlords and passive real estate investors are typically exempt from this requirement for work related to their own rental properties. Generally, businesses must file Form 1099-MISC if they've made more than $600 in payments to one or more independent contractors. The first section of the Schedule E is about 1099s. Get the most recent version and learn more here from the IRS: 1099s

0 kommentar(er)

0 kommentar(er)